Meeka Metals Limited (ASX:MEK) has a portfolio of high quality 100% owned projects across Western Australia.

Meeka’s Flagship Murchison Gold Project

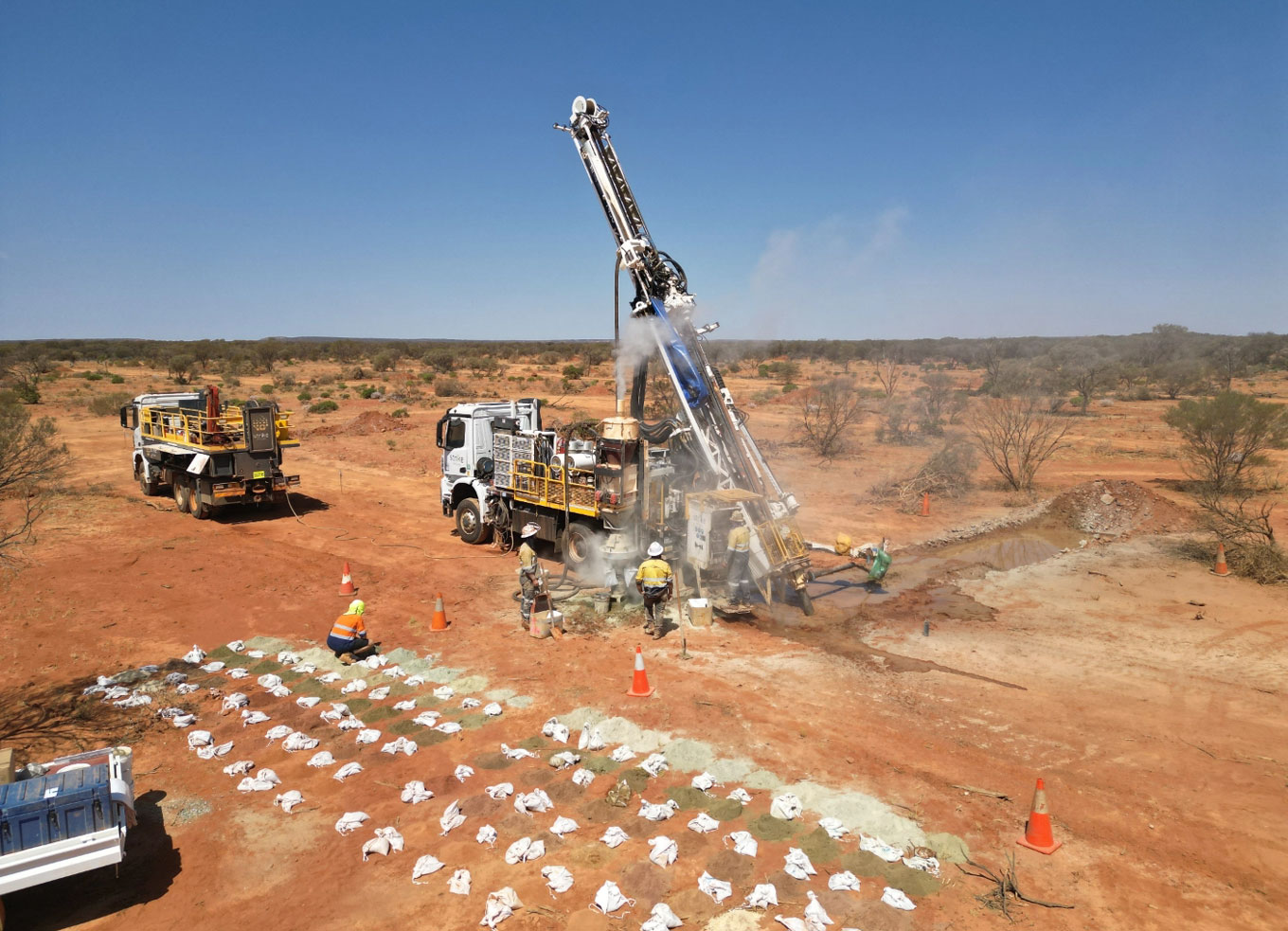

Meeka’s flagship Murchison Gold Project has a combined 281km2 landholding in the prolific Murchison Gold Fields and hosts a large high-grade 1.2Moz Mineral Resource. The Company is actively growing these mineral resources while also progressing toward production. The Company has achieved exploration success in 2022 with the definition of multiple new high-grade lodes at St Anne’s and high-grade extensions to Turnberry.

In addition, Meeka owns the Circle Valley Project (222km2) in the Albany-Fraser Mobile Belt (also host to the Tropicana gold mine – 3Moz past production). Gold mineralisation has been identified in four separate locations at Circle Valley and presents an exciting growth opportunity for the Company.

Project Portfolio

Murchison

Gold Project

Meeka’s flagship Murchison Gold Project has a combined 281km² landholding in the prolific Murchison Gold Fields and hosts a large high-grade 1.2Moz Mineral Resource.

Circle Valley

Gold Project

Meeka owns the Circle Valley Project (222km²) in the Albany-Fraser Mobile Belt (also host to the Tropicana gold mine – 3Moz past production).

The pathway to mine development

The Company is also progressing through a staged pathway to mine development. The release of the Murchison Gold Project Feasibility Study in July 2023 outlined a straightforward development strategy.

The Study displayed meaningful production and financial outcomes for the Company over an initial 9.3 year production plan.

Latest ASX Announcements